Q4 Financial Health: A Fractional CFO’s Guide to 2026 Growth | Giles Financial Consulting

Beyond the Books: A Fractional CFO’s Guide to Why Your Q4 Financial Health is Key to 2026 Growth

As we enter Q4, the drive for year-end revenue is palpable. But as a Fractional CFO, I see a critical pivot point that many business owners miss: this quarter is not just about closing sales, it’s about auditing your financial foundation. The clarity and accuracy of your books right now are what will determine your tax liability, your access to capital, and your ability to execute a winning strategy in 2026. Poor bookkeeping isn’t an administrative error; it’s a strategic liability that silently caps your growth.

Section 1: The Strategic View: Why Your Q4 Books Are Your Most Important Asset

Think of your year-end financials as the dashboard for your business. You wouldn’t race a car with a broken speedometer and foggy windows. Similarly, entering the new year with messy books means you’re driving blind.

- Tax Strategy, Not Just Tax Filing: The IRS sees your records as a historical report. A Fractional CFO analyzes them as a strategic tool. Sloppy books lead to missed opportunities for deferrals, credits, and deductions, resulting in an unnecessarily high tax bill.

- Funding & Growth: Whether seeking a loan or investor, “guestimated” numbers are a non-starter. Clean, accurate, and professionally prepared financial statements (like a P&L and Balance Sheet) are the currency of credibility and your ticket to growth capital.

- From Reactive to Proactive: Clean books provide the data needed to move from wondering how you performed to knowing where you can improve, pivot, and invest.

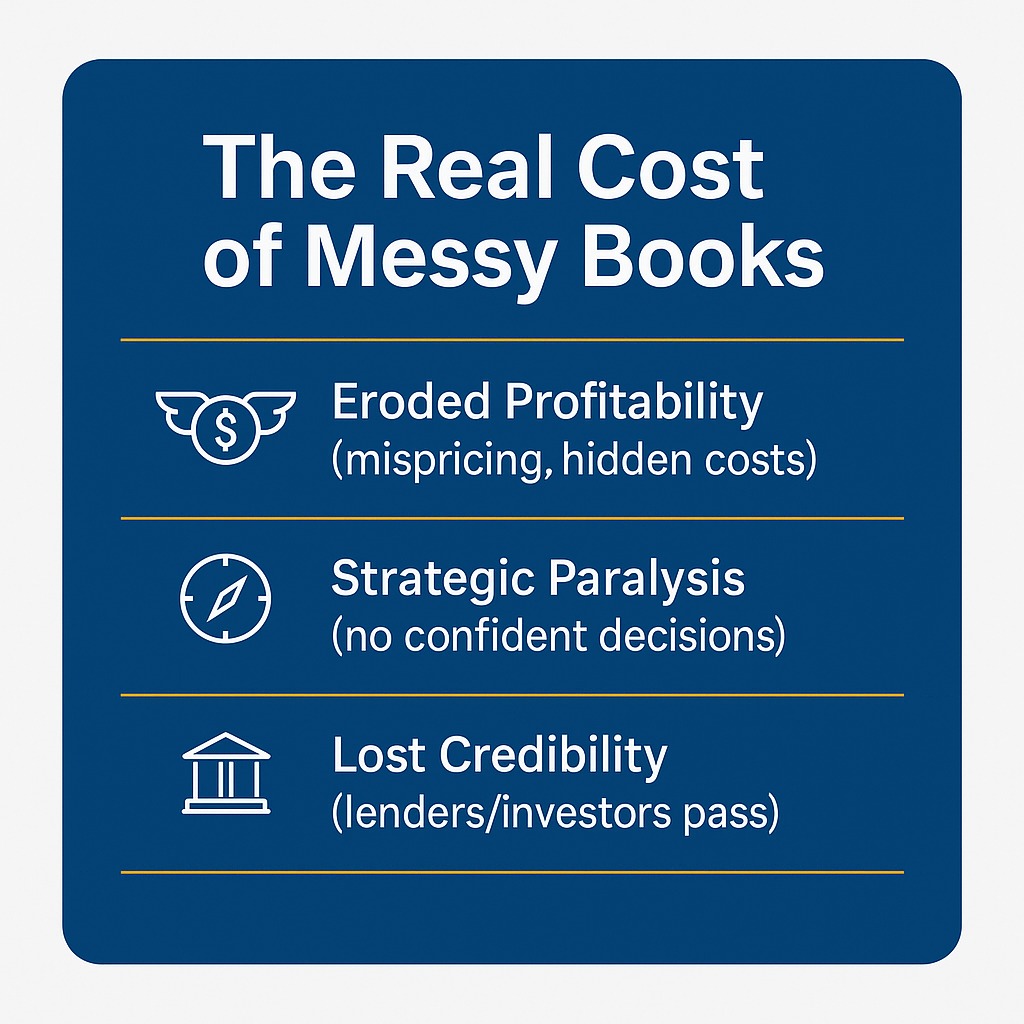

2: The True Cost: What Poor Financial Hygiene Really Drains From Your Business

Most owners see bookkeeping as a cost. I help them see that not doing it right is the real expense.

- Eroded Profitability: This goes beyond overpaying taxes. It’s mis-categorized expenses that hide the true cost of your services, leading to underpricing. It’s a lack of clarity on your most profitable revenue streams.

- Strategic Paralysis: Inaccurate cash flow forecasts mean you can’t confidently hire, invest in marketing, or purchase new equipment. You’re stuck reacting to your bank balance instead of acting on a plan.

- Lost Credibility & Opportunity: When a lender asks for a detail you can’t provide, the door closes. Poor records signal a lack of operational maturity, scaring away the very partners who could help you scale.

- The Founder’s Time Tax: The January scramble to reconstruct a year’s worth of transactions is a massive drain on your most valuable resource—your time and mental energy. This is time stolen from strategic planning.

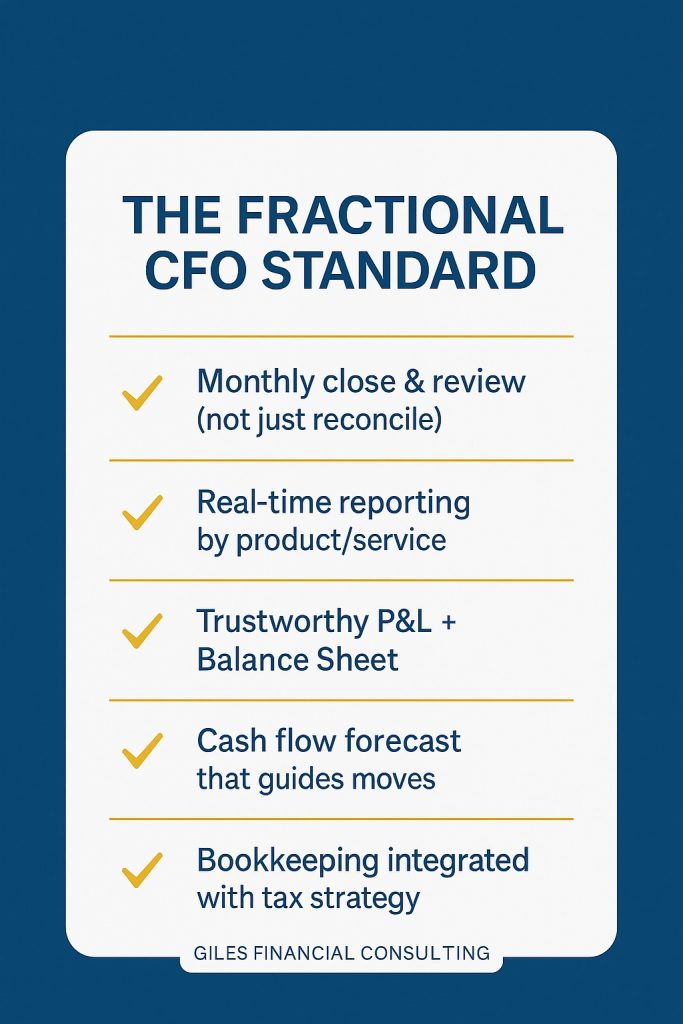

Section 3: The Fractional CFO Standard: What Financially Confident Businesses Have in Place

This isn’t just about “clean books.” It’s about building a financial system that empowers decision-making.

- Monthly Close & Review Process: Not just a reconciliation, but a formal monthly review of financial statements to understand the story behind the numbers.

- Accurate, Real-Time Reporting: A Chart of Accounts that provides granular insight into profitability by product, service, or division. No “miscellaneous” black holes.

- Strategic Financial Documents: A P&L that you can trust, a Balance Sheet that reflects your true financial position, and a Cash Flow Forecast that acts as your roadmap.

- An Integrated Tax Strategy: Your bookkeeping isn’t separate from your tax planning; it’s the foundation of it. Every transaction is recorded with its tax implications in mind.

Section 4: Your Q4 Action Plan: Partner with a CFO, Not Just a Bookkeeper

You don’t have to face this alone. Here is the strategic path to getting on track:

- Commission a Q4 Financial Diagnostic: We don’t just “catch up” your books. We conduct a thorough review of your financials, identify gaps, and build a strategic plan for the next 90 days and beyond.

- Reconcile and Strategize: We’ll ensure every account is reconciled and every transaction is accurately categorized, turning your raw data into an intelligible strategic asset.

- Develop Your 2026 Financial Roadmap: This is the core of CFO advisory. We’ll use your clean data to model scenarios, plan for tax efficiency, and set the financial targets that will guide your growth in the new year.

- Establish a VPartner for Growth: As your Fractional CFO, I become an extension of your leadership team, providing the ongoing insight and strategic oversight to ensure you’re not just counting dollars, but making your dollars count.

Your Focus

This Q4, shift your focus from merely reporting on the past to building your future. The cost of inaction is no longer just a missed deduction; it’s a missed opportunity for growth.

👉 Ready to transform your financials from a source of stress into your greatest strategic advantage? Schedule your complimentary Q4 Financial Strategy Session with Giles Financial Consulting. Together, we’ll clean up the past and build a clear, confident plan for 2026.

Starting a small business is exciting, but let’s face it—it’s also overwhelming. Between juggling ideas, managing finances, and building a customer base, it’s easy to get caught up in the day-to-day hustle. That’s where a business plan comes in. Think of it as your roadmap: a strategic tool to guide you from where you are now to where you want to go.

Starting a small business is exciting, but let’s face it—it’s also overwhelming. Between juggling ideas, managing finances, and building a customer base, it’s easy to get caught up in the day-to-day hustle. That’s where a business plan comes in. Think of it as your roadmap: a strategic tool to guide you from where you are now to where you want to go.